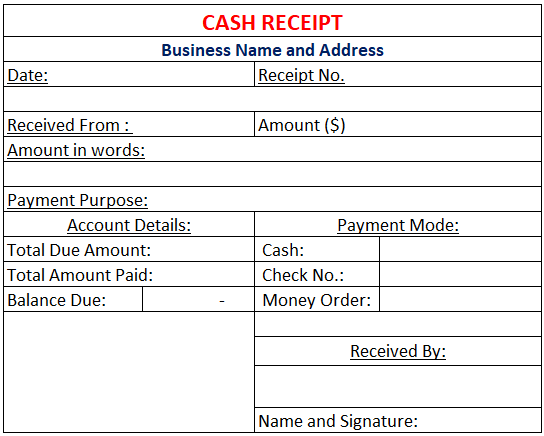

One of the major advantages of the cash book format for Excel: The program offsets the items directly with each other and automatically displays the current balance. Even something as simple as the purchase of stamps – a classic cash payment – belongs in the cash book. Here, the principle of completeness is very important. All incurred income and expenses are documented chronologically. You then just have to put your signature under the table. In the header of the cash book template, there are two additional fields: one to enter the name of your company, and another for recording the time during which the respective cash book sheet was kept.

Our downloadable blank cash book template contains all the details that are necessary for a properly filled out cash book. To ensure this, there are some mandatory entries that each cash book entry needs to have. Like all other commercial books, the cash book must be kept in accordance with the principles of transparency and comprehensibility. When you submit your tax return to the IRS at the end of a fiscal year, the cash book is part of the company’s tax base. But first of all, we explain who is actually involved in keeping a cash book. In the following, you’ll find a template for your cash book as well as all important information about how to fill it out correctly. Simply download the corresponding blank cash book template online. In this way, digital cash book templates offer a direct overview of the financial situation of a company and spare the need for time-consuming calculations – where errors can easily creep in.Ī cash book template also has advantages for all self-employed individuals – regardless of whether you’re obligated to keep a cash book or not. The advantage of a digital cash book format using an Excel spreadsheet: It’s quick, clear, and the entered amounts are automatically offset against each other.

Corresponding templates are a great help. Keeping a cash book helps ensure that this list is complete. After all, if the annual financial statements are due at the end of the fiscal year, the IRS doesn’t only want to see the transactions done via debit or credit, but also a list of all cash transactions. In the form of a simple document, often an Excel spreadsheet, the cash book is used to record a company’s cash payments. The cash book is one of the most important accounting books for corporate bookkeeping.

0 kommentar(er)

0 kommentar(er)